Use Cases in Insurance Industry

- Publised October, 2025

Discover how AgentIQ AI transform customer support and advisor efficiency in the insurance industry through two real-world use cases.

Table of Contents

Toggle

The insurance industry operates with complex policies and massive data volumes. Two persistent challenges stand out:

Advisors struggle to stay updated on policy details, terms, and benefits.

Customers experience delays or inconsistent responses when seeking help.

AgentIQ AI implemented AI Agents powered by a structured Knowledge Base (KB) tailored for the insurance domain. Below are two case studies illustrating how this approach drives measurable impact.

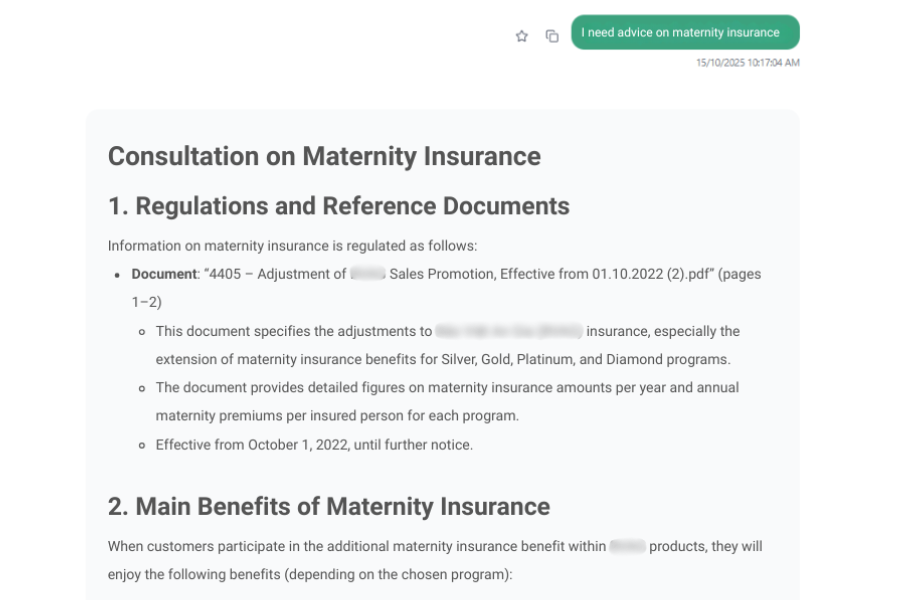

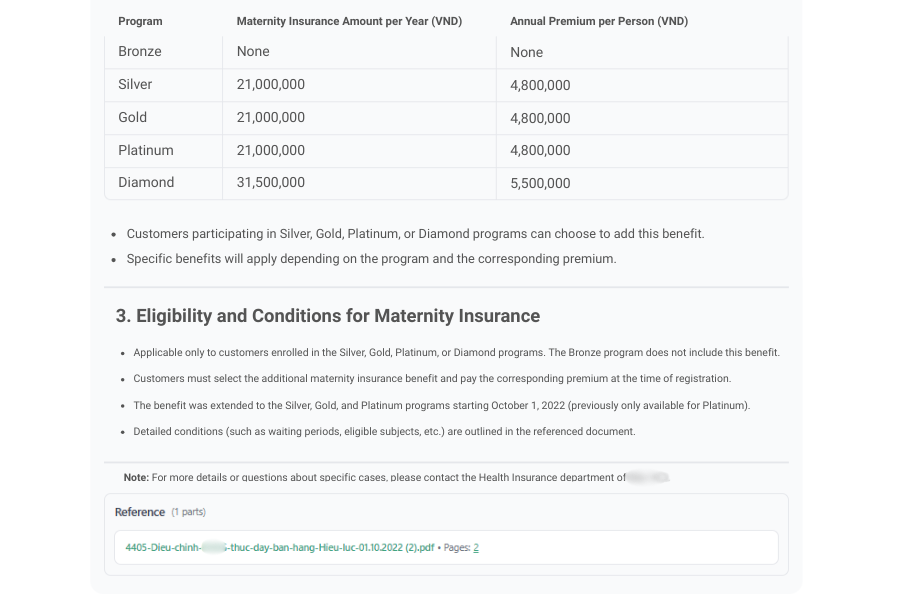

Use case 1: Customer Support Agent — Providing accurate information about service packages

Context

An insurance company sought to enhance the customer experience, especially for clients exploring maternity insurance packages. Previously, clients had to wait for advisor responses or manually navigate scattered documents.

Solution

AgentIQ AI deployed a Customer Support Agent trained on the company’s verified KB containing policy details, claim procedures, and benefit structures.

Clients could chat directly with the Agent via website or mobile app.

The Agent provided instant, verified answers to questions such as “I need advice on maternity insurance” or “Which maternity plan fits a 30-year-old client?”.

All information was sourced from approved enterprise knowledge, ensuring accuracy and consistency.

Results

Customer response times are reduced.

Customer satisfaction is increased.

Support team workload is reduced, freeing up time for consultants to handle complex cases.

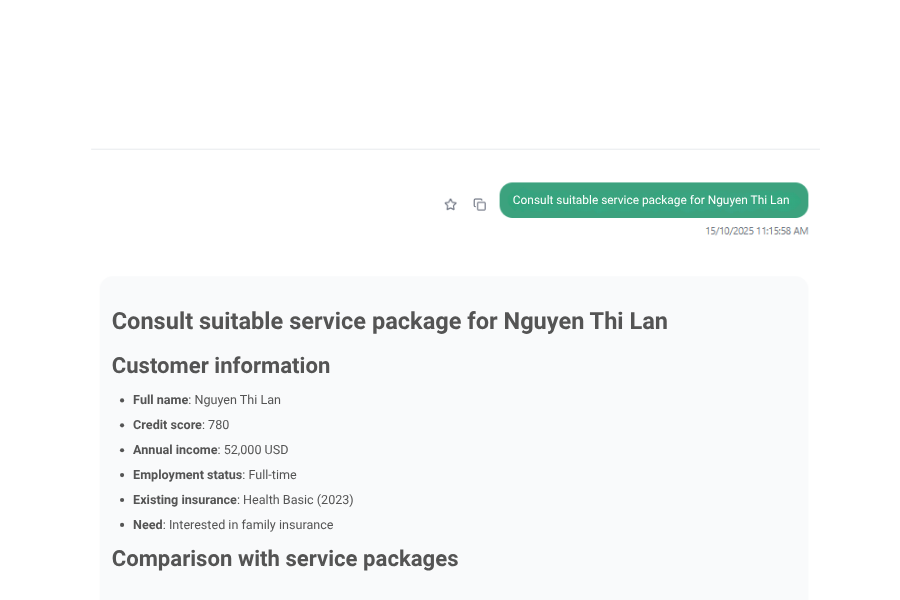

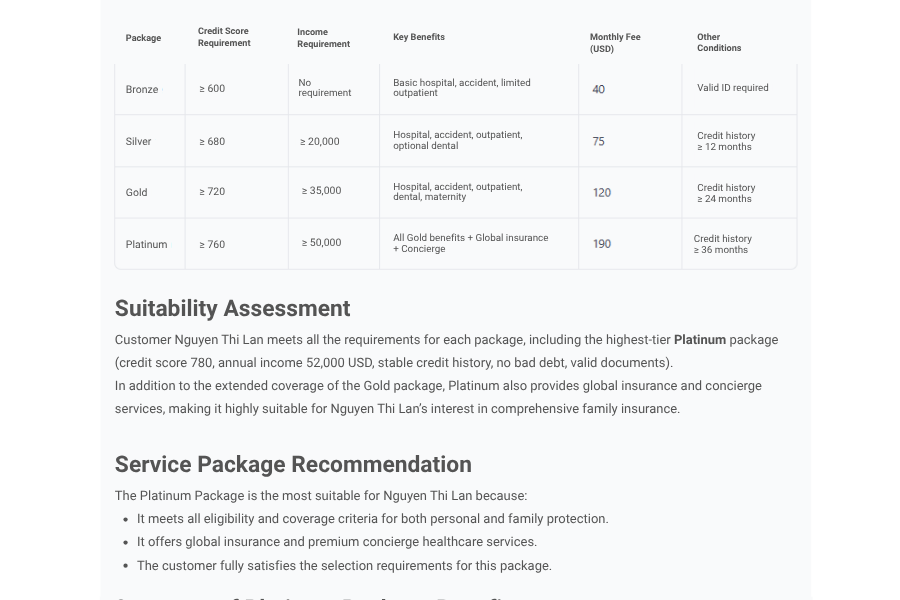

Use case 2: Advisor Assistant Agent — Recommending Suitable Insurance Packages

Context

Insurance advisors needed to recall dozens of products with unique terms and eligibility rules. Manual lookups were time-consuming and error-prone, reducing both efficiency and conversion rates.

Solution

AgentIQ AI introduced an Advisor Assistant Agent connected directly to the enterprise Knowledge Base, which included:

Detailed product data and pricing structures.

Regulatory and compliance guidelines.

Customer profile templates (with full data privacy compliance).

Advisors could simply enter client details such as age, income, and protection goals. The Agent then suggested suitable insurance packages and generated personalized consultation scripts.

Results

Consultation preparation time dropped from 30 minutes to 5 minutes.

Conversion rate improved.

Advisors maintained compliance and reduced misinformation errors.

Conclusion

AI Agents built on your enterprise Knowledge Base empower both customers and advisors – delivering instant, verified information that drives trust and efficiency.

For insurers, this means more than automation, it means transforming every interaction into structured knowledge that strengthens long-term customer relationships.

With AgentIQ AI, your organization gains a secure, continuously improving knowledge infrastructure, where every customer query and advisor consultation helps your AI Agents learn and deliver smarter responses.

Your Knowledge, Your Agents, Your Control